How they work: The card skimmer steals your information off the magnetic strip on the back of your credit/debit card. The thieves then create a clone of your card and make quick work of draining your account. Often your pin number can be also stolen by someone lurking and “shoulder surfing” you at the ATM or there may be a hidden camera within a pin hole opening watching the key pad.

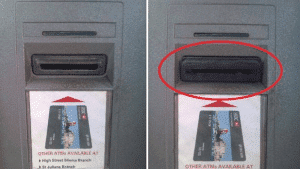

How to spot card skimmers: Card skimmers are not as easy to catch without really looking at the machine you are using. The typical skimming device is smaller than a deck of cards that fits over the existing card reader.

- Always be aware of your surroundings. Be sure that no one is watching over your shoulder or from a distance.

- Check for obvious signs of tampering at the top of the ATM, near the speakers, the side of the screen, the card reader itself and the keyboard. If something looks different, such as a different color on material, graphics that aren’t aligned correctly, or anything else that doesn’t look right, don’t use that card reader.

- Take a look at the next ATM or gas pump to compare them. If there are obvious differences, don’t use either one and report it.

- One way to prevent them from getting the pin number if there are cameras is to just simply cover your hand.

- If you think the ATM, gas pump you are using may have a card skimming device attached to it; inform the person on duty.

- Cameras will be pointing to the pin pad. These are disguised as something else (mirrors, outlets, lights, brochure holders, etc.) and will have a tiny hole for the pinhead camera to watch for your pin number.

- Thieves can install a fake keypad over the existing keypad that will record your pin number. If they keypad seems off, too thick or wiggles about it’s probably not safe to use.

How to Avoid Skimming Fraud:

- If you need to make a withdrawal, drive up to the teller window and ignore the ATM altogether.

- When paying for gas, pay inside.

- When you can be sure to use cash as payment.

- Never store debit or credit card information on the computer; hackers may get access to your information.

What to do if you think your card information has been stolen:

If you believe that your card has been compromised or you notice transactions that you did authorize; cancel/turn off your card through your mobile app or call the bank immediately and have the card cancelled. Be sure to report any unauthorized transactions to your bank or credit card company.